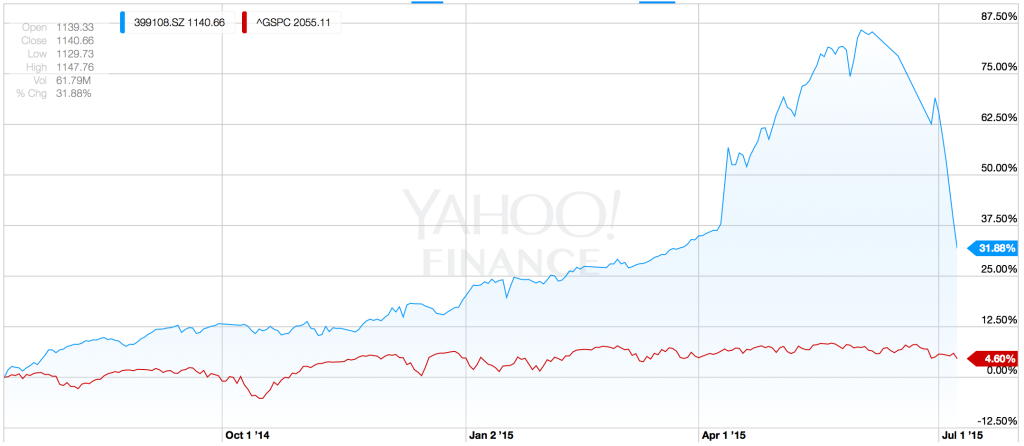

Time magazine aptly pointed out that prices listed on the exchanges in China are listed in red when prices are rising and green when prices are falling, opposite of the U.S. markets, owed to the fact that red is a lucky color in China.1 Green has certainly been the dominant color for Chinese markets over the past few weeks, with major Chinese indices down as much as 30% from the year’s highs. Of course, at the market high, the Shenzhen index (used as a measure of Chinese equity) had nearly doubled over the course of the trailing 12 months and, even with the 30% retracement, is still outperforming U.S. counterparts.2 This pullback has some investors wondering whether a buying opportunity may soon present itself.

As far as the situation in Greece (outlined in a previous article on our website – https://www.yourlegacyfoundation.com/staging/2015/06/24/get-ready-4000-point-dow-drop/), decision makers have at least agreed to take negotiations to the 11th hour. The troika; a body composed of the European Central Bank (ECB), the International Monetary Fund (IMF) and the European Union (EU); has given Greece a last chance to produce a credible economic reform plan, which it will evaluate on Sunday and then decide whether Greece will be allowed to stay in the eurozone.

The ultimate consequences of a Greece exit from the Eurozone, termed by pundits as a ‘Grexit’, are ambiguous at best. Donald Tusk, head of the European Council, was quoted as referring to the crisis as “the most critical moment in the history of the European Union”.3 Comparatively, business magnate and accomplished investor Warren Buffett said, “If it turns out that the Greeks leave, that may not be a bad thing for the euro.”4

Ironically, the turmoil abroad may motivate our Federal Reserve to delay hiking interest rates which, in turn, could ultimately see domestic markets move higher – despite the recent volatility. The Federal Reserve minutes, which were released at 2pm today, indicated mixed perspectives moving forward. All of these scenarios are carefully weighted in constructing our investment portfolios.

Of course, no strategy can protect against a loss of principal or guarantee a particular rate of return. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All Performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

1 http://time.com/3949062/china-stock-market-shanghai/

2 Figures generated by http://www.finance.yahoo.com

3 http://www.telegraph.co.uk/finance/economics/11725041/Five-days-to-save-the-eurozone-from-disaster.html

4 http://www.cnbc.com/id/102551722

Recent Comments