You may have heard about how European and Japanese central banks have been adopting increasingly unconventional monetary policies, most notably lowering their short-term interest rate to below 0%. Yes, although hard to believe, many countries around the world now have negative interest rates, with banks effectively charging customers for holding their money.

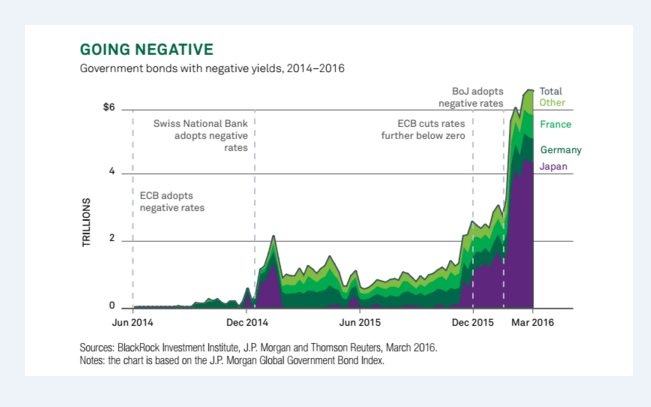

After multiple rounds of quantitative easing (QE) failed to increase the rate of inflation to 2% or higher, negative interest rates have been used by a number of central banks, including the Swiss National Bank, the Bank of Japan, and the European Central Bank (ECB), to encourage consumer spending, fight deflationary forces and stimulate economic activity. There are currently five currencies and 23 countries that are now practicing some form of negative interest rate policies (NIRP).

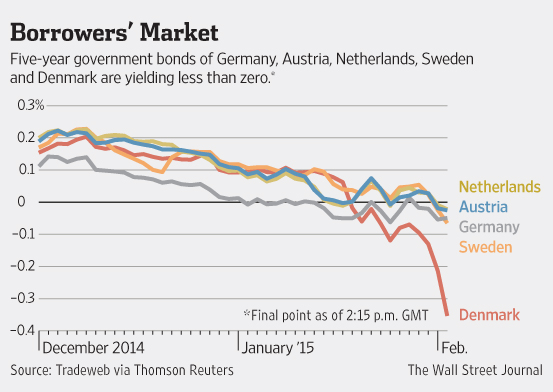

Additionally, other central banks, such as Denmark’s Nationalbank and the Bank of Sweden, introduced negative interest rates in an effort to counter the appreciation of their currencies caused by other countries’ expansionary monetary policies. A depreciating currency makes a nation’s exports cheaper and imports more expensive relative to other currencies. In effect, a weaker currency has the potential to boost a country’s exports and fight deflation.

However, currency devaluations are generally a zero-sum game. Weakness in one currency leads to strength in others. Radical monetary policy frequently triggers even more radical monetary policy. NIRP often leads to currency wars. As an example, the ECB’s unprecedented wave of “easy money” was successful in weakening the euro, but added to the appreciation pressure on the Swiss franc and the Danish kroner. This led to the Swiss and Danish central banks responding by further cutting interest rates to below zero to try and reverse the monetary tightening caused by currency appreciation.

Since central banks provide a benchmark for all borrowing costs, negative rates apply to a range of debt securities. Consequently, the yields of several government bonds are now below zero, including German 10-year bunds, Japanese 10-year bonds and all Swiss government bonds. Through July, about $10 trillion of government bonds worldwide had nominal yields below zero.

Even more astounding is the fact that according to the World Gold Council, about 50% of the world’s $30 trillion of developed nations’ sovereign debt is yielding less than 0% in real terms (factoring in inflation when calculating actual returns). That means $15 trillion worth of government debt is providing a negative return to investors after taking inflation into account.

The bottom line is the furious decline in government bond yields around the world caused by negative interest rate policies has made things incredibly difficult for income-hungry investors, most of whom are retirees.

Companies find it cheaper and easier to borrow money in a negative interest rate environment because positive-yielding corporate bonds look much more attractive to investors compared with negative-yielding government bonds. Thus, corporations can issue corporate bonds to investors with miniscule interest rates. In 2015, Apple was able raise more than $1 billion dollars from Swiss investors by issuing bonds that yielded less than 1%.

Also, declines in yields on government bonds are generally thought to push investors into riskier assets (such as stocks) as they seek out higher returns. Therefore, negative interest rates should theoretically be a boon for stock prices since investors are expected to ditch negative-yielding bonds and buy positive-yielding stocks for greater returns. In reality, NIRP has lowered the opportunity cost and boosted the attractiveness of holding “safe haven” assets that provide no yield, such as gold and silver. The prices of gold and silver are up about 25% and 35%, respectively, since the start of 2016.

Ultimately, NIRP remains untested and unproven as an effective monetary tool. Sooner or later, central banks will have to consider the serious challenges that NIRP poses to the business models and profitability of banks, insurers, pension funds and other institutions that depend on higher rates to fund their operations. The Bank for International Settlements, a counterparty and trustee for 60 central banks, starkly warned in a March 2016 report of “great uncertainty” if rates were to remain negative for a prolonged period of time or were to decline even further into negative territory.

The extent of NIRP around the world is unprecedented; we are in uncharted waters. That said NIRP has seemingly resulted in more harm than good and effectively has both introduced and elevated risks, many of which (unfortunately) remain unknown.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Recent Comments