The low volatility anomaly describes the fact that stocks that are deemed as “low risk” by MPT metrics have higher expected returns than those considered “high risk.” Baker and Haugen (2012) say this anomaly is “remarkable because it is persistent – existing now and as far back in time as we can see.” They go on to show that this anomaly is present not only in United States equity markets, but “that it extends to all equity markets in the world,” in bother developed and emerging markets. Their paper presents a very significant finding, as it contradicts what is seemingly the foundation of investing, “that risk bearing can be expected to produce a reward.”

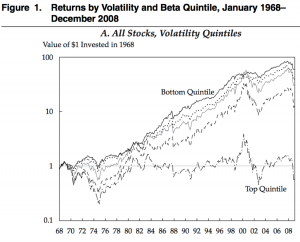

Research by Baker, Bradley, and Wurgler (2011) also shows that low volatility stocks outperform high volatility stocks in the long run. The figure below on the next page shows the return of $1 invested in 1968 in each of five quintiles of stocks divided by volatility and beta measurements. The bottom quintile (or lowest risk) stocks outperform the upper four quintiles from January 1968 to December 2008.

(Source: Baker, Bradley, and Wurgler 2011)

Baker and Haugen (2012) take these findings a step further by calculating the average annual return and risk of stocks in the lowest decile of risk (lowest volatility) versus stocks in the highest decile of risk (highest volatility). The figure below illustrates the stark contrast in risk and returns between these two groups of stocks over the 21 year period from 1990 to 2011. It clearly shows a negative relationship between the risk of an investment and its corresponding return.

Annual Risk and Return in All Countries Universe (Developed and Emerging Markets)

(Source: Baker and Haugen 2012)

The implications of the findings in these papers are significant with regards to portfolio construction. According to the results of the aforementioned studies, investor looking for long-term capital appreciation is more likely to achieve their goal through the use of low volatility, low beta stocks, which contradicts the conventional wisdom that higher risk can potentially mean higher returns. While past performance provides no guarantee of future results, the evidence is clear that the low volatility anomaly delivers substantial risk-adjusted returns over the course of time, and thus should be considered when choosing equity positions in a portfolio with a long-term time horizon.

Works cited:

Baker, M.; Bradley, B.; Wurgler, J. Financial Analysts Journal 2011, 67, 1, 40-54

Baker, N.L.; Haugen, R.A. Social Science Research Network 2012, http://ssrn.com/abstract=205543

Recent Comments