Until this year, any individual whose adjusted gross income was above $100,000 was restricted in being able to convert a traditional IRA, SEP IRA or Simple IRA into a Roth IRA. The benefit of a Roth is that all growth on a principle amount is tax free for future withdrawal purposes. There are still restrictions on making contribution to a Roth with your after tax money with a maximum adjusted Gross income of $105, 000 for singles and a AGI of $167,000 for joint tax filers. Just a note to consider with these maximums. Those who are able to reduce their AGI through contributions to their 401(k) , 403(b) or 457 plans may quality to make contribution.

Due to the current deficit, the government put together an incentive to raise revenues sooner rather than later through Roth Conversions. This approach allows tax payers to convert IRA’s, Rollover IRA’s and dormant 401(k)’s to Roths, thus collecting tax revenues immediately.

The benefits will vary from one individual to the next and the financial implication should be examined carefully. In 2010, there are special provisions for those who wish to take advantage of the conversion concerning any tax that would be due. This year only, you may pay the taxes on the income from a traditional IRA over a two year time period – half in 2011 and the remainder in 2012. Keep in mind you must make the conversion in the year 2010. For some, this allows them to put aside a savings account to accumulate either part or all of the money that would be due for taxes spread over time.

It is not advisable to withhold taxes from the IRA before you convert, as you will miss out on the tax free growth of those dollars.

For estate planning purposes, the Roth has a step-up provision whereby the assets pass income tax free to beneficiaries. Currently most individuals pass their IRA accounts to a spouse upon death which remains tax deferred. Though passing assets to non spouse beneficiaries do not have this tax deferred preference let alone tax free.

Individuals that are retired will be required to start taking distributions from the traditional IRA accounts at age 70 ½ . The amount is calculated based on IRS tables and the account balance on December 31st of each year. The amount increases to be withdrawn increases with age.

The Roth doesn’t have a distribution requirement, therefore, each individual can decide when and how retirement income is distributed.

The impact of tax free growth is very compelling to many, especially in light of the increasing tax proposed as part of deficit reduction strategies.

What type of triggering events can occur in order to consider a conversion opportunity? Once you terminate services with one employer, you have the ability to take any accumulated retirement benefits and roll them over into a Roth also changing job status such as, being a Resident or Fellow in a hospital. Under these circumstances, it is likely that the income will be much greater in the future along with increased taxes. Divorce settlements that require a Qualified Domestic Order that split pension accumulations. Going from a full time to part time position that may reduce your income and be more favorable for paying taxes.

Note that once you open a Roth, you cannot withdrawal funds until the account is 5 years old or you are 59 ½ – whichever occurs later.

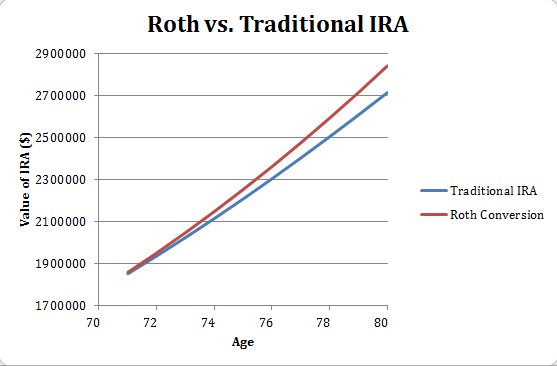

Below please find a graph that demonstrates the impact of converting a traditional IRA into a roth and how both the tax consequence and growth impact the future outcome.

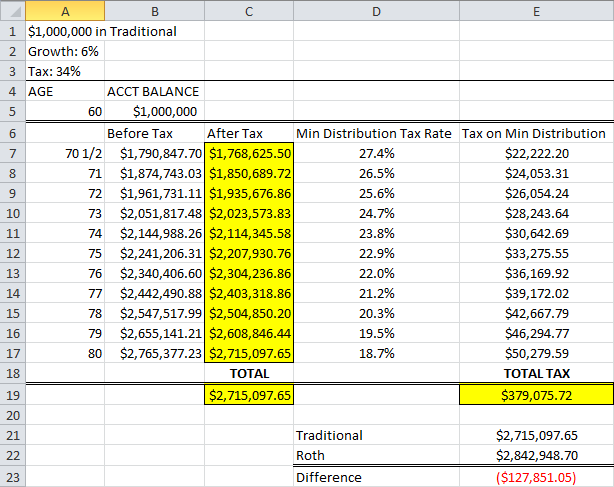

The tables below demonstrate the difference between a Traditional IRA and a Roth as well as the gain an investor will realize by converting to a Roth. Table 1 breaks down a one million dollar investment from the time an investor is 60 to up to 80 years of age. From 60 to 70 1/2 years of age a $1,000,000 IRA grows to $1,790,847.70 at an annual rate of 6%. At 701/2 the investor begins taking a Required Minimum Distribution (RMD) on the $1,790,847.70 that has accrued. The RMD’s are taxed at a 34% rate due to the investors income bracket (this tax rate will change on a case to case basis). You can see the annual tax on the RMD in Column D. The investment continues to grow at an annual rate of 6% however now this sum of money is being taxed. At the age of 80 the investor has $2,715,097.65 (Table 1, Cell B19). This investment has been taxed for a total of $379,075.72 (Table 1, Cell E19) over the past 10 years.

Table 1

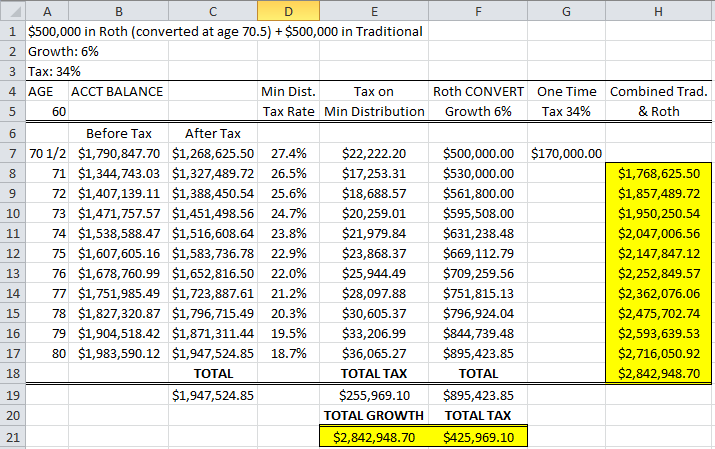

Table 2

Table 2 allows you to see a hypothetical scenario of a Roth IRA. As in table 1, the investor starts with the initial amount of $1,000,000 at age of 60. This investment grows at an annual rate of 6% over 10 years to $1,790,847.70. At the age of 701/2 the investor converts $500,000 to a Roth IRA leaving 1,290,847.70 in a Traditional IRA. The investor pays a onetime tax of 34% on the $500,000 Roth conversion equaling $170,000, however, after this up-front tax the Roth can experience tax free growth with no RMD’s as you can see in Column J. Also, please note that now there is less money in the Traditional IRA than there was in Table 1. This means that the RMD’s will be less than that of the investment in Table 1. In turn, the taxes on the RMD’s will also decrease.

When comparing the Traditional IRA with the Roth we see several important factors that I will address. The first factor is the total taxes the investor will pay in each option. As you can see, the investor will pay $379,075.72 in taxes in a Traditional IRA (Table 1, Cell E17). In a Roth the investor will pay $425,969.10 (Table 2, Cell L21), an additional $46,893.38. Do not let the higher taxes deter you from converting to a Roth however. The tax free growth the $500,000 experiences far outweighs the tax burden. Even with more money lost to taxes, the Roth out performs the Traditional IRA by $127,851.05 (Table 1. Cell E23). The higher returns can be contributed to the $500,000 that experienced tax free growth over a period of 10 years. Though each individual’s retirement outlook will change based on his or her tax bracket, age, and additional variables, it is clear to see the advantages of converting to a Roth IRA.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Recent Comments