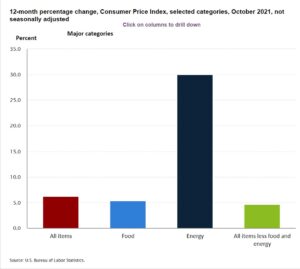

Lately, there has been significant media coverage about the sharp rise in inflation after the latest data released by the U.S. Bureau of Labor Statistics (BLS) showed that the Consumer Price Index (CPI), which measures the change in prices paid by consumers for goods and services, increased by 6.2%. When this inflation measure is seasonally adjusted, meaning it considers that turkey prices tend to rise around Thanksgiving, etc., and excluding more volatile food and energy prices, the BLS report showed that consumer prices (inflation) still rose by an eyebrow-raising 4.6%. This was the largest 12-month increase since August 1991, and it is well above the U.S Federal Reserve’s (Fed) 2% target rate for inflation. In fact, and perhaps ironically, the only two categories that experienced price declines during this same period were airline fares and alcoholic beverages; however, we are not concluding there is any relationship between the two. (https://www.bls.gov/news.release/cpi.nr0.htm)

https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category.htm

While some of these inflation headlines can be alarming, and we are sure that most have experienced more than a few of these reported price increases firsthand, we believe it is important to understand why this COVID-recovery inflation is occurring and how it may impact the economy and your retirement portfolios.

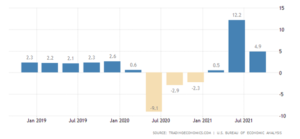

When the U.S. Federal Reserve (Fed) began to stimulate the economy during the early stages of the COVID crisis, their primary goal was to maintain price stability (prevent deflation) and regain full employment – the level that existed before the crisis. Even though the Fed took quick and decisive action, there was a delay in their stimulus program’s impact on the economy. For the next three quarters after the Fed’s initial stimulus efforts, U.S. GDP contracted, meeting the technical definition of a recession. Since many parts of the global economy also were at a standstill due to COVID, the price of several goods and services tracked by the CPI data also experienced price declines. This year-over-year comparison – last year’s low or negative price data vs. this year’s strongly positive CPI data – is an example of what the Fed and other economists call the Base Effect – a percentage increase based on easy comparison data. We agree that this Base Effect, as described by the Fed, is at least partially responsible for the sharp rise in the inflation data. The good news is that based on upcoming quarterly GDP comparison data, it is likely that the Fed’s stimulative impact will subside in upcoming quarters and start to normalize at a lower rate.

U.S. GDP – Quarterly Growth Rate (in %)

https://tradingeconomics.com/united-states/gdp-growth-annual

A second factor impacting inflation, and familiar to anyone who has recently tried to purchase a new (or used) car or truck, are the well-publicized issues that continue to affect the global supply chain. Earlier this year, as the economy began to reopen, demand for new vehicles sharply rebounded. Unfortunately, the supply of vehicles was (and still is) constrained by any number of global supply chain issues, including a critical semiconductor shortage. It is no surprise that a sharp increase in demand coupled with a lower supply of goods or services can quickly lead to higher prices. And this is what seems to be reflected in the recent inflation data. Eventually, we believe many of the supply chain issues will self-correct as current global manufacturing and transportation network bottlenecks begin to subside. Unfortunately, because of the worldwide spike in COVID cases, it could be a while before the problems with the global supply chain are corrected.

That is why at The Legacy Foundation, we have added investments in our clients’ retirement accounts that increase the exposure to areas of the economy that have the ability to pass along at least some inflation costs – namely, in basic materials and real estate. We have also added to critical industries like infrastructure, renewables, and water resources.

As the post-COVID economic recovery continues to gain steam, one of the main challenges the Fed has struggled with is raising the labor force participation rate. This measure, which tracks the number of people 16 years or older who are either employed or actively looking for work, is perhaps more important than the unemployment rate. This is because it accounts for people actively seeking employment, including those who may be long-term unemployed. Although the latest reported unemployment rate, at 4.6%, has declined to near pre-COVID levels, labor force participation remains at a stubbornly low at 61.6%. Many believe this is the main reason why the Fed only recently announced it will start to taper its monthly bond purchase program and begin to reduce its monetary stimulus to the U.S. economy. We believe this policy change is important, as it signals that the Fed may move away from its current near-zero policy target over the next 12 to 18 months. While the timing of any rate hikes will be determined at future Fed policy meetings, it seems increasingly likely that rates will rise – we do hope gradually – in the future. Again, we see this change in the Fed’s accommodative policies as a clear positive since it could only occur with the support of a robust economic recovery.

In anticipation of this rising interest rate environment, The Legacy Foundation has been increasing our clients’ investment exposure to the Financials sector, which tends to perform well during periods of rising interest rates. We have also reduced our clients’ allocation to parts of the fixed-income market with longer duration – think long-term bonds – to reduce the risk from rising rates. These changes could have a more significant impact if the Fed, at one of its upcoming policy meetings, surprises the market by increasing either the pace or size of its rate increases. As a brief reminder, bond prices tend to move in the opposite direction of interest rates. Therefore, if interest rates were to increase at a higher rate than expected, the price decline of these longer-duration bond investments could more than offset any increase in yield.

As we approach year-end and start to prepare our New Year’s resolutions for 2022, The Legacy Foundation continues to maintain a positive outlook on the U.S. economy. However, we also acknowledge and fully expect there will be periods of higher volatility as market dynamics play a daily game of tug o’ war between data supporting a robust post-COVID recovery against a shifting priority of investor concerns – including rising interest rates, inflation, critical material shortages, global supply chain disruptions, COVID resurgence, uncertain U.S. fiscal policy, and even an increase in geopolitical risk. However, despite known or future headwinds, we still see the U.S. economy maintaining its robust trajectory well into the New Year.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. Economic forecasts set forth may not develop as predicted. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond and bond mutual fund values and yields will decline as interest rates rise and bonds are subject to availability and change in price. Investing in stock includes numerous specific risks including the fluctuation of dividends, loss of principal, and potential illiquidity of the investment in a falling market. Investing in foreign and emerging market securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks. Investment Advice offered through Private Advisor Group, LLC, a Registered Investment Advisor.

Recent Comments