There have been three primary drivers regarding the most recent market volatility, the ongoing US/China trade conflict, increasing signs of slowing US economic growth, and data indicating that global manufacturing is slowing for the first time in 3 years. Looking ahead, September poses its own challenges. Over the last 50 years, September has been the worst month for stock returns, posting an average decline of 0.92%, according to Bespoke Investment Group. Mutual fund managers and other financial professionals typically start selling underperforming stocks in the third quarter, mainly in September, as they begin to bolster their returns for the end of the year.

Since 2018, earnings in the US have met expectations, and interest rates have fallen; however, trade remains an ongoing risk. Uncertainty continues to play a role in markets and their volatility. The unpredictability of leadership in the US and China has fueled additional uncertainty.

Most investors are better served by sticking to the asset allocation plan that is defined according to their risk profile and by avoiding the temptation to ‘time the market.’ However, it’s equally important to periodically revisit your risk profile, which is dependent on your investment time horizon and your emotional tolerance to market volatility.

Your asset allocation should be paired with your risk profile; this determines the appropriate mixture of stocks, bonds, and alternative investments – which may include real estate and commodities. Because there are many different asset classes, it’s important to understand how each investment contributes to the overall volatility of your retirement portfolio. Equally important is how each investment compares to other assets classes and peers. The idea behind asset allocation is not only used to determine your risk exposure, but it also serves as a basic guideline for the amount of diversification that is required in your retirement portfolio in order to for you to achieve your long or short term financial goals.

We often provide reviews for new clients of their existing portfolios, and the most common problem is the high degree of correlation in their equity allocation. Even though most believed that by choosing different equity funds in their retirement accounts, they were well-diversified, in reality, their investments performed very similarly during periods of market volatility.

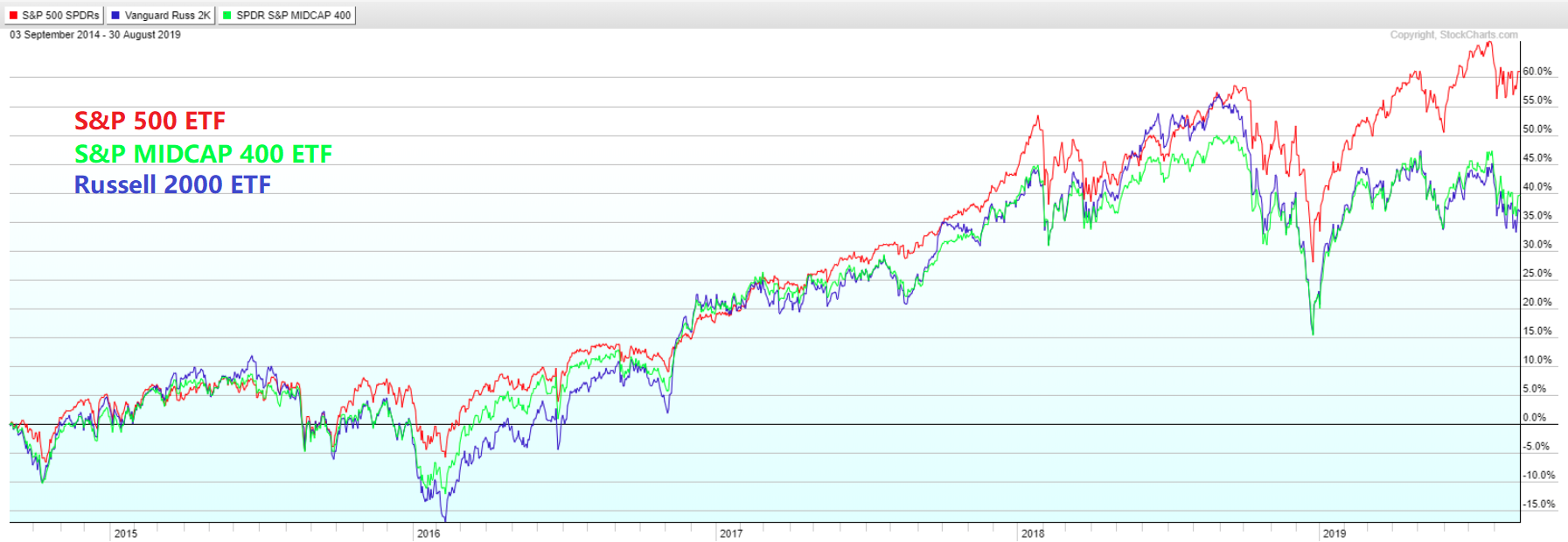

To illustrate this point, one would think that investing in large-cap, small-cap and mid-cap equities would provide some level of diversification. However, as seen from the chart below, which compares the performance of the S&P500, Russell 2000 and S&P400 indexes over the past five years, it clearly shows how closely each of these asset classes performs with each other and how little diversification benefit is gained by owning all of these “different” investments.

Source: Stockcharts.com as of September 3, 2019.

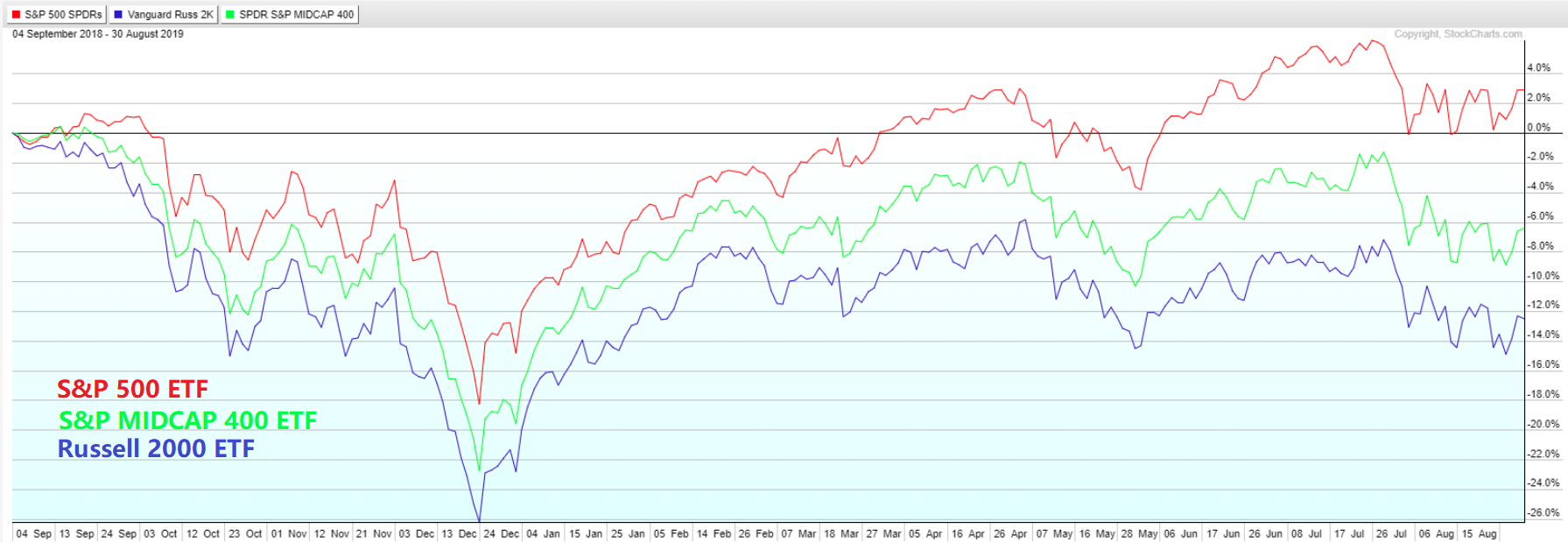

Things look even more correlated when looking at the same investments over a 1-year period.

Source: Stockcharts.com as of September 3, 2019.

The charts also illustrate the point that simply adding to the number of investments in your retirement portfolio doesn’t necessarily reduce the correlation or the relationship between these ‘different’ asset classes.

One of the reasons we diversify our clients’ portfolios is to help mitigate the risk associated with market volatility. However, as the previous charts show, that doesn’t always work if you have closely correlated investments. Another key factor is understanding the impact that asset diversification has on the balance between risk and reward in your retirement portfolio. One might think that if you choose to invest in small-cap stocks, which have a higher level of market volatility, then you would likely be rewarded for taking that additional risk. However, that is not necessarily true for all small-cap funds. It is also important to understand how each asset class behaves during different phases of the economic cycle, whether your current asset allocation is correctly matched with risk your profile, and will your retirement portfolio perform in the manner that you expected. Another point worth mentioning is that not all mutual funds perform the same, even within the same asset class. Therefore, selecting the right fund is just as important as choosing the correct mix of assets.

At the Legacy Foundation, we have been providing complimentary retirement portfolio reviews to university employees for over 30 years. An important part of our financial education process is helping you to understand the importance of asset allocation and how the investments in your retirement portfolio will perform during periods, as we have experienced more recently, of elevated market volatility. Therefore, we feel this is an excellent time to reassess your risk profile, particularly if you haven’t done so within the last five years or if you are nearing retirement.

Recent Comments