Dear Friends,

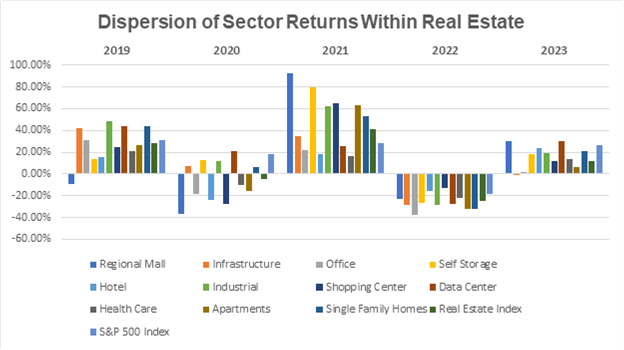

In the past two weeks, the S&P500 index soared to a new record high and surpassed 5,000 with more than 5% return in 2024. Meanwhile, the Nikkei 225, Japan’s equity market index, has also shown exceptional performance, booking over a 10% return year-to-date. In our efforts to diversify our clients’ models, international exposure certainly plays an important role, and we feel that Japan offers significant growth opportunities when looking at its earnings growth and evolving corporate governance. In terms of fixed income, we have also introduced global bonds which have proven to bring more diversity and competitive performance. While real estate was a leading asset class for several years, 2022 changed that in a dramatic way with increasing interest rates and vacant office buildings. That being said, there’s still a housing shortage and there are promising trends developing in home construction which will continue to strengthen as interest rates soften over time. The chart below provides an interesting look at how the various sectors of real estate have performed over the last five years.

Data source: National Association of Realtors4

Economy, Geopolitics, and Commodities

1. Hotter-Than-Expected Inflation Clouds Rate-Cut Outlook

Inflation eased again in January but came in above Wall Street’s expectations, clouding the Federal Reserve’s path to rate cuts and potentially giving the central bank breathing space to wait until the middle of the year. The Labor Department reported Tuesday that consumer prices rose 3.1% in January from a year earlier, versus a December gain of 3.4%. That marked the lowest reading since June. Still, the consumer-price index was higher than the predicted 2.9%, a disappointment for investors who hope the Fed will cut rates sooner rather than later. Rate cuts tend to help stock prices by boosting economic activity and reducing competition from bonds for investor dollars. For many investors, Tuesday represented a realization: Disinflation was easy in 2023 when inflation fell from 6.4% at the start of the year to 3.4% in December. That this happened without the widely anticipated rise in unemployment or even recession came as a pleasant surprise and led some to hope the path back to the Fed’s 2% target would also be relatively easy. Although January’s report is just one month’s data, it raises the risk that the path could be uneven.

The Fed’s preferred measure of inflation has been running cooler than the Labor Department’s, and analysts said that could continue in January. The figures released Tuesday calculate medical care and airfares differently, and those categories were especially strong in January. The Labor Department’s measure also puts a much higher weight on shelter costs, which for both owners and renters are derived from rents. Shelter costs accounted for 0.23 percentage points of the monthly gain in overall prices in January. Shelter costs were up 0.6% month over month. Economists generally expect inflation to cool down this year, though they caution the process could be bumpy. Cooling prices for newly signed leases, for example, should eventually translate into lower shelter costs.1

2. US Homebuilder Sentiment Climbed to Six-Month High in February

Sentiment among US homebuilders rose to a six-month high in February as buyers continued to take advantage of mortgage rates that have fallen from their October peaks. The National Association of Home Builders/Wells Fargo gauge of housing market conditions rose by 4 points to 48 this month, according to data released Thursday. That beat the median estimate in a Bloomberg survey of economists that called for a reading of 46. Builder sentiment began rebounding late last year as mortgage rates declined, falling below 7% in December. While borrowing costs have started to rise again, that hasn’t yet undermined the nascent recovery in the new-homes market. The Federal Reserve has signaled a willingness to lower interest rates this year, though progress in lowering inflation has slowed, pushing back expectations for when the central bank might start its cuts.

The NAHB’s measure of expected sales increased three points, while gauges of prospective buyer traffic and current sales also rose. Builder sentiment climbed in all four regions of the US, with especially strong gains in the West and Northeast. With mortgage rates still down from their fall peaks, fewer builders are cutting prices to lure customers. In February, 25% of builders reported cutting prices, compared with 31% who trimmed prices a month earlier. The average price reduction has stayed at 6% for eight months. The share of builders offering incentives to customers also declined, to 58% in February from 62%. It was the smallest share offering incentives since August. Overall, the NAHB expects single-family starts to rise about 5% this year, NAHB Chief Economist Robert Dietz said in the statement.2

3. UK Economy Slipped Into Technical Recession at the End of 2023

The U.K. economy slipped into a technical recession in the final quarter of last year, initial figures showed Thursday. The Office for National Statistics said the U.K. gross domestic product shrank by 0.3% in the final three months of the year, notching the second consecutive quarterly decline. Though there is no official definition of a recession, two straight quarters of negative growth is widely considered a technical recession. Economists polled by Reuters had produced a consensus forecast of -0.1% for the October to December period. All three main sectors of the economy contracted in the fourth quarter, with the ONS noting declines of 0.2% in services, 1% in production, and 1.3% in construction output. Across the whole of 2023, the British GDP is estimated to have increased by just 0.1%, compared to 2022. For December, output shrank by 0.1%.

Inflation has come down markedly in the U.K. but remains well above that of the country’s economic peers and the Bank of England’s 2% target, squeezing household finances. The headline consumer price index reading came in at 4% year-on-year in January. Notably, GDP per capita — which adjusts for population growth — contracted by 0.6% in the fourth quarter, after a 0.4% decline in the previous three months, and fell further through each quarter of last year. Over the whole of 2023, seasonally adjusted GDP per head shrank by 0.7%. U.K. Finance Minister Jeremy Hunt said that high inflation remains “the single biggest barrier to growth,” since it is forcing the Bank of England to keep interest rates firm and stymie economic growth.5

4. Natural Gas Export Fight

Americans’ utility bills are getting wrapped up in the fight over President Biden’s pause on most new natural gas exports. The White House last month effectively froze new approvals for liquefied natural gas shipments, a booming industry that has helped turn the U.S. into an energy export powerhouse. While environmentalists are urging officials to scrutinize projects’ impact on the climate, producers warn the pause could kneecap the country’s ability to supply allies with fuel in the future. Now, Americans’ power and heating costs are becoming a growing part of the tug of war.

As the Energy Department weighs new criteria for greenlighting future exports, some manufacturing groups and consumer advocates warn that America’s ties to global markets could make price instability more likely. The fear is that additional projects in the next decade could push up Americans’ heat and power bills, as well as costs to make everything from drywall to steel. The domestic impact of LNG exports has been hotly contested since the country began funneling more gas-laden tankers to foreign buyers in 2016. While record production has largely kept U.S. costs low, international shocks in recent years have helped whipsaw prices to shale-era highs and have contributed to some of the most volatile periods in decades. In Virginia and neighboring states, companies including paper mills and breweries increasingly throttle back operations when local prices surge on cold days, said Mary Hensley, director of marketing at Enspire Energy.1

5. Dozens of Banks Rapidly Piled Up Commercial Property Loans

About two dozen banks in the US had portfolios of commercial real estate loans in late 2023 that federal regulators indicated would merit greater scrutiny, a sign more lenders may face pressure from authorities to bolster reserves. A trio of regulators publicly warned the industry last year to carefully assess any large exposures to debt on office buildings, retail storefronts, and other commercial properties. Office buildings were the biggest casualties as post-Covid changes in working patterns and poor energy efficiency combined with rising interest rates to crush values.

While New York Community Bancorp, which set off a cascade of stock drops in recent weeks as it braced for potential loan losses, was the biggest US bank that came close to fitting the regulators’ criteria, many smaller lenders went further. That’s because they amassed outsize concentrations even faster, according to a Bloomberg analysis of federal data from more than 350 bank holding companies. The three watchdogs — the Federal Reserve, Federal Deposit Insurance Corp., and Office of the Comptroller of the Currency — indicated they would focus on banks whose portfolios of commercial real estate loans are more than triple their capital. Within that pool, examiners would zero in on portfolios that had grown dramatically: at least 50% in the past three years.2

Financial Markets

1. Major Index End 5-Week Winning Run

Stocks slid Friday after, yet another hot inflation report stoked fears that Federal Reserve rate cuts may not arrive until later than anticipated this year. The S&P 500 fell 0.48% to end at 5,005.57, and the Dow Jones Industrial Average slid 145.13 points, or 0.37%, settling at 38,627.99. The Nasdaq Composite lost 0.82% to finish at 15,775.65. All three major indexes broke their five-week winning streak to end the week in the negative.

The producer price index for January, a measure of wholesale inflation, increased 0.3%. Economists polled by Dow Jones had anticipated a gain of 0.1%. Excluding food and energy, core PPI increased 0.5%, higher than the expectations for a 0.1% advance. The 10-year Treasury yield jumped above 4.3% following the hot PPI reading. The 2-year Treasury yield topped 4.7%, the highest since December. It’s been a roller coaster week for stocks, with investors carefully assessing the direction of the U.S. economy and when the Federal Reserve may decide to lower rates. On Tuesday, the Dow posted its biggest daily decline in nearly a year after January’s headline consumer price index reading came in at 3.1%, higher than the 2.9% economists polled by Dow Jones were expecting. The market shook off the report over the next two days, with the S&P 500 rebounding on Thursday to close at yet another record high. But Friday’s wholesale inflation report added to concerns the Fed may have to wait until later in the year before it starts cutting rates.5

2. Warren Buffett’s Berkshire Hathaway Trims Its Massive Stake in Apple

Warren Buffett’s Berkshire Hathaway trimmed its flagship position in Apple in the fourth quarter. Berkshire sold about 1% of its Apple shares in the final three months of 2023, leaving it with a 5.9% stake in the iPhone maker worth about $167 billion on Wednesday, according to Dow Jones Market Data.

The Apple position held by Berkshire Hathaway has grown to an outsize share of its more than $300 billion stock portfolio. As the tailwinds of the tech trade pushed Apple shares higher, investors who follow the company have wondered how much bigger Buffett and his deputies would allow the position to grow. Apple shares have soared 367% since the end of 2018, while the S&P 500 has about doubled. Buffett praised Apple at Berkshire’s annual meeting last year, saying “it just happens to be a better business than any we own.” Apple shares, however, haven’t kept pace with those of some of its Big Tech peers in recent months. The company lost its crown as the U.S.’s most valuable company to Microsoft earlier this year. Apple has faced a slew of challenges, including regulatory scrutiny of its App Store policies, declining sales in China, and investor worries about its growth prospects. Several analysts have downgraded the stock. Apple shares are down more than 4% in 2024.1

3. FTC, HHS Administration Examining Cause of Generic Drug Shortages

The Federal Trade Commission on Wednesday said it is examining the role that drug wholesalers and companies that purchase medicines for U.S. health-care providers play in shortages of generic drugs, which account for most Americans’ prescriptions. The move follows an unprecedented shortfall of crucial medicine ranging from injectable cancer therapies to generics, or cheaper versions of brand-name medicines, over the last year, which has forced hospitals and patients to ration drugs. Problems from manufacturing quality control to demand surges can drive supply issues.

In a joint request for information, the FTC and the Department of Health and Human Services are seeking public comment on the contracting practices, market concentration, and compensation of two types of middlemen. They are group purchasing organizations, which broker drug purchases for hospitals and other health-care providers, and drug wholesalers, which buy medicines from manufacturers and distribute them to providers. The FTC and HHS did not name specific companies. But Vizient, Premier, and HealthTrust are among the biggest group purchasing organizations for hospitals, while Cencora, Cardinal Health, and McKesson are responsible for roughly 90% of prescription drug distribution in the U.S. The public will have 60 days to submit comments at Regulations.gov, the FTC said. Group purchasing organizations and wholesalers have gotten limited attention on Capitol Hill, even as reining in high drug costs has become a key priority among lawmakers in both chambers.3

4. Cisco To Cut More Than 4,000 Jobs, Lowers Annual Revenue Forecast

Cisco Systems said it would cut 5% of its global workforce or more than 4,000 jobs, and lowered its annual revenue target as the company navigates a tough economy that has led to thousands of layoffs by tech firms this year. Shares of the networking equipment maker fell more than 5% in extended trading on Wednesday, after Cisco cut the forecast to $51.5 billion to $52.5 billion from $53.8 billion to $55 billion, as it projected earlier.

“We also continue to see weak demand with our telco and cable service provider customers,” CEO Charles Robbins said in a conference call. Analysts expect demand for Cisco’s products to remain under pressure, as clients in the telecom industry restrict spending, prioritizing clearing their excess inventory of networking gear. The networking hardware inventory pile-up should be resolved in the second half of 2024 or early 2025, Joe Brunetto, an analyst at Third Bridge said. Meanwhile, Cisco is focusing on artificial intelligence and partnership with Nvidia to boost growth. CEO Robbins said Nvidia agreed to use Cisco’s ethernet with its technology that is widely used in data centers and AI applications. Cisco expects third-quarter revenue to be between $12.1 billion and $12.3 billion, below estimates of $13.1 billion, according to LSEG data. The company, which has 85,000 employees, was planning layoffs and restructuring to focus on high-growth areas, three sources familiar with the matter told Reuters earlier this month.3

5. Google Rolls Out Updated AI Model

Alphabet Inc.’s Google is rolling out a new version of its powerful artificial intelligence model that it says can handle larger amounts of text and video than products made by competitors. The updated AI model, called Gemini 1.5 Pro, will be available on Thursday to cloud customers and developers so they can test its new features and eventually create new commercial applications. Google and its rivals have spent billions to ramp up their capabilities in generative AI and are keen to attract corporate clients to show their investments are paying off.

“We’re focusing first and foremost today on delivering you the research that enabled this model,” Oriol Vinyals, a Google vice-president and Gemini co-tech lead said in a briefing with reporters. “Tomorrow, we’re excited to see what the world will make of the new capabilities.” The mid-size version of the new AI model, Gemini 1.5 Pro, performs at a level like the larger Gemini 1.0 Ultra model, Google said. Since OpenAI’s runaway success in late 2022 with its conversational chatbot ChatGPT, Google has been angling to show that it, too, is a force in cutting-edge generative AI technology, which can create new text, images, or even video based on user prompts. More companies have been experimenting with the technology, which can be used to automate tasks like coding, summarizing reports, or creating marketing campaigns. Now, Google is seeking to lure those users into its ecosystem with even more powerful tools. Gemini 1.5 can be trained faster and more efficiently and can process a huge amount of information each time it’s prompted, according to Vinyals. For example, developers can use Gemini 1.5 Pro to query up to an hour’s worth of video, 11 hours of audio, or more than 700,000 words in a document, an amount of data that Google says is the “longest context window” of any large-scale AI model yet. Gemini 1.5 can process far more data compared with what the latest AI models from OpenAI and Anthropic can handle, according to Google.2

Sources:

(1) www.wsj.com

(2) www.bloomberg.com

(3) www.reuters.com

(4) www.nar.realtor

(5) www.cnbc.com

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. Economic forecasts set forth may not develop as predicted.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond and bond mutual fund values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Investing in stock includes numerous specific risks, including the fluctuation of dividends, loss of principal, and potential illiquidity of the investment in a falling market.

Investing in foreign and emerging market securities involves special additional risks. These risks include but are not limited to currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

Investment advice offered through Private Advisor Group, a registered investment advisor and separate entity from The Legacy Foundation.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The Legacy Foundation and LPL Financial do not offer tax advice.

Recent Comments