Dear Friends,

2024 is a leap year and taking that extra day to implement financial planning strategies can serve you well for decades to come!

We have included in this week’s newsletter a number of financial goals to consider for 2024. As you give thought to the future, please know that The Legacy Foundation can help you prioritize your planning goals and provide investment strategies paired with your individual needs. Your success in legacy planning depends on your knowledge of the available options as well as the knowledge of those who will advocate for you in your later years. We’re here to provide that education and partnership.

Reviewing your beneficiaries and making sure you have both primary and contingent beneficiaries listed on insurance policies, retirement accounts, and non-retirement accounts, often referred to as TOD (Transfer On Death) accounts, is critical.

Some important questions to ask yourself when reviewing your own estate plans can be found below.

- Do you have a Power of Attorney, and do you need to update the representatives? Do you have a successor representative?

- Consider whether naming an individual beneficiary or the need for a Trust would be more appropriate for your estate planning strategies.

- Do you have too much money in a passbook savings account or checking account that could be reallocated to CDs or Money Market accounts for a higher return?

- Would you benefit from using Tax-Free Municipal investment vehicles because you’re in a higher tax bracket?

- If you are still employed, are you maximizing your employer retirement programs and is it better to use a Traditional 403(b), a Roth 403(b), or both?

- If you are 5 – 7 years from retirement, have you put together a Capital Needs Analysis and an income distribution plan?

- Are you aware of the potential tax implications of your various investments when passing them to heirs or charitable organizations?

- Do the individuals who will advocate for you in your later years understand your estate planning goals and wishes? Family meetings are a great way to help ensure an understanding of your plan.

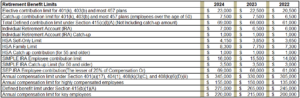

As we begin thinking about the new year, here are some updates for 2024 regarding tax-favored accounts. Make sure you are taking advantage of these programs to help ensure you can maintain the same lifestyle in retirement!

www.irs.gov

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. Economic forecasts set forth may not develop as predicted.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond and bond mutual fund values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Investing in stock includes numerous specific risks, including the fluctuation of dividends, loss of principal, and potential illiquidity of the investment in a falling market.

Investing in foreign and emerging market securities involves special additional risks. These risks include but are not limited to currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

Investment advice offered through Private Advisor Group, a registered investment advisor and separate entity from The Legacy Foundation.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The Legacy Foundation and LPL Financial do not offer tax advice.

Recent Comments